How To Change The View On Bill Pay Bank Of America

How to make Apple tree Card payments

Come across how to brand a payment, check your balance, and choose a payment source.

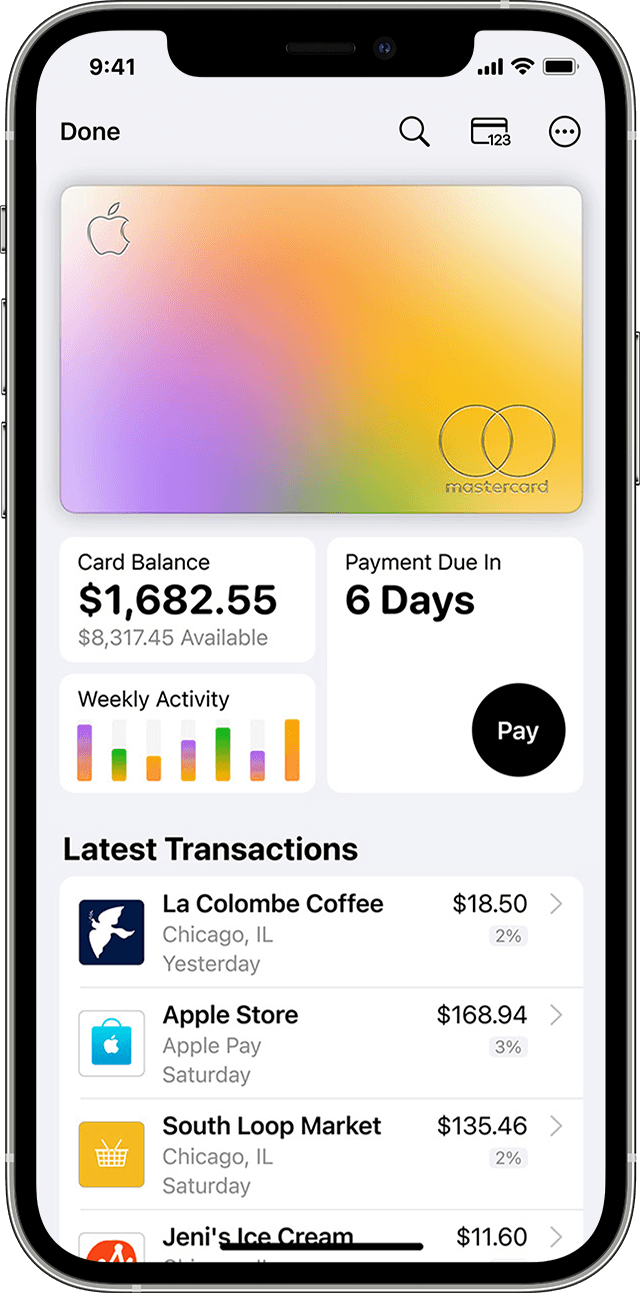

Cheque your residual

To see your Card Balance, open the Wallet app on your iPhone and tap Apple Card.1 The Card Rest shows below your card. Card Balance includes all new spending and whatsoever remaining monthly residual. If you have Apple tree Card Monthly Installments, then your balance includes the newly billed monthly installment.

Y'all can simply pay off purchases after they clear, so Card Rest will continue to reflect awaiting transactions, even if you make a maximum payment.

Detect your monthly balance

The monthly residual includes all of your spending in a calendar calendar month (except for any awaiting transactions), interest charges, and credits posted to your account. It also includes whatsoever remaining balance from the previous calendar month. If you have Apple Card Monthly Installments,2 your monthly rest includes your involvement-free monthly installment. When you pay the monthly balance, it stops additional interest charges on your account.

- Open up the Wallet app on your iPhone and tap Apple Menu.

- Tap to pay.

- Your monthly balance is automatically selected and you see a light-green checkmark.

If yous already paid some of your monthly balance, your remaining monthly remainder is shown. If you pay off your monthly balance each month by the due date, you aren't charged interest.

Find your minimum payment due

The minimum payment is the minimum amount y'all must pay towards your Apple Card rest to continue your account current.

- Open up the Wallet app on your iPhone and tap Apple tree Card.

- Tap to pay.

- Press and slide counterclockwise until the bicycle turns red and stops.

- You see the minimum payment due.

When your minimum payment is due, Payment Due appears with the amount below your Apple Card. If yous bought an iPhone, iPad, Mac, or other eligible Apple tree product with Apple Card Monthly Installments, your monthly installment is included in the minimum payment amount.

How to make payments

Yous can set upward recurring scheduled payments or make a one-time payment in the Wallet app with merely a few taps. If you don't have an eligible iPhone or iPad, you can make an Apple Bill of fare payment online at carte.apple tree.com.

For Apple tree Carte Family, account owners and co-owners are responsible for all payments on the shared Apple tree Card account. On a co-owned account, each co-possessor can make payments on the account and tin add together a banking concern account. Before making or scheduling a payment on a shared Apple Card account, co-owners should verify that the correct banking concern account is selected.3

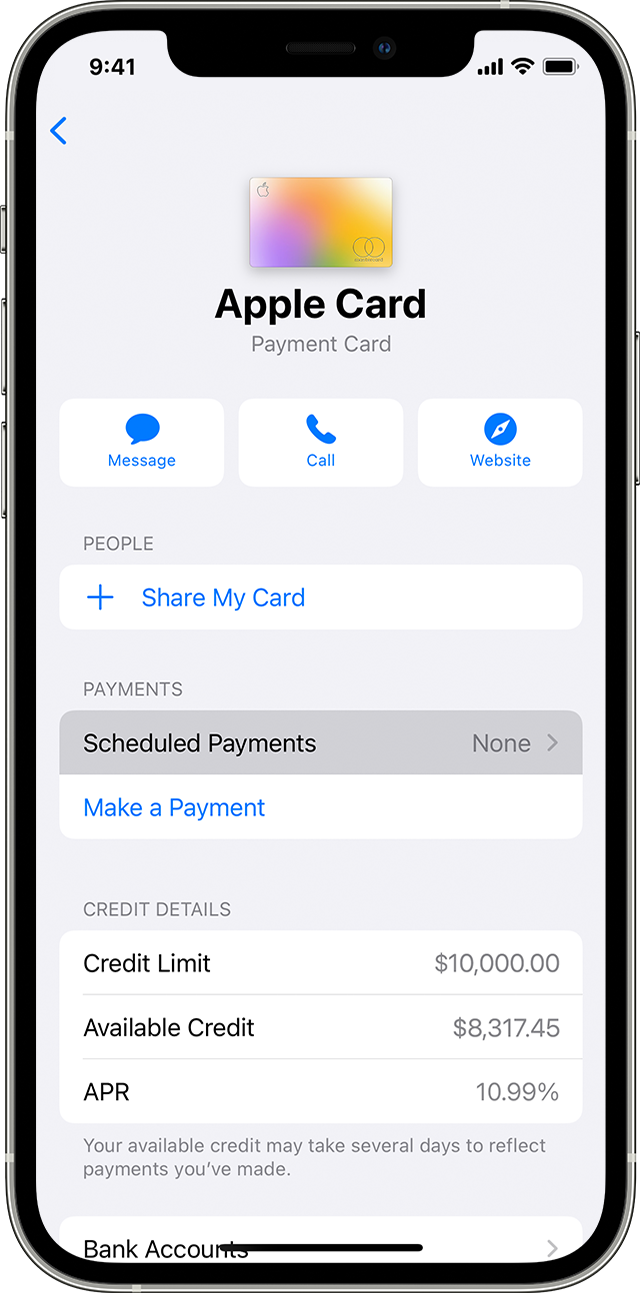

Set up scheduled payments for Apple Card

- Open the Wallet app on your iPhone and tap Apple tree Card.

- Tap the more push button

, tap Scheduled Payments, then tap Continue.

, tap Scheduled Payments, then tap Continue. - Tap Pay My Bill to pay your previous monthly balance or tap Pay Different Amount to choose an amount. And then tap next:

- If you chose Pay My Bill, select when you lot want your payment to be made, and then tap Next.

- If you chose Pay Different Amount, select your payment amount, when you want the payment to repeat, when you desire the commencement payment to exist made, and then tap Next.

- Confirm with Confront ID, Bear on ID, or passcode.

- Tap Done.

If y'all desire to change your scheduled payment, you lot need to showtime cancel your current scheduled payment. Just tap the more push ![]() , then tap your scheduled payment nether Scheduled Payments. Tap Cancel Payments and tap Cancel Payments again to confirm your choice.

, then tap your scheduled payment nether Scheduled Payments. Tap Cancel Payments and tap Cancel Payments again to confirm your choice.

Make a one-fourth dimension payment

Pay now

To make an firsthand one-time payment, follow these steps:

- Open the Wallet app on your iPhone and tap Apple Bill of fare.

- Tap to pay.

- Concord and slide the payment cycle to choose a payment amount.

- Tap Pay Now to instantly make your payment, then follow the instructions on your screen.

Pay after

Hither's how to schedule a quondam payment:

- Open the Wallet app on your iPhone, tap Apple Carte, then tap to pay.

- Hold and slide the payment wheel to cull a payment amount, then tap Pay Afterwards.

- Choose the date you desire to make the payment.4

- Tap Pay on [your called date], so follow the instructions on your screen.

Make boosted payments on your Apple Card Monthly Installments

If you pay your minimum payment due each month, you're automatically paying your Apple Card Monthly Installment for that month. To brand an boosted payment or pay off your installment balance, you demand to pay your Maximum Payment for all other Apple Card purchases before additional payments can be applied to your installment rest.

Learn how to pay extra towards your Apple Card Monthly Installments.

Apple Card Monthly Installments are involvement-free and all other purchases you make with your Apple Card accept a variable Apr.2 When y'all pay toward your Apple Card balance first, y'all can reduce or eliminate involvement charges.

If you pay more than towards your installment rest, you might reduce the number of payments, but you're still required to pay your installment the next month.

If your iPhone or iPad is unavailable

If your iPhone is missing or stolen, you tin can call an Apple Menu specialist to make a payment. You lot can also ask an Apple tree Card specialist to help you set upward scheduled payments so you won't miss a payment.

If you added your Apple Menu to another iPhone, you can brand a payment or fix scheduled payments in the Wallet app on that iPhone. If you lot added your Apple Bill of fare to your iPad, you tin become to Settings > Wallet & Apple Pay > Apple Card, then tap Brand a Payment or gear up Scheduled Payments.

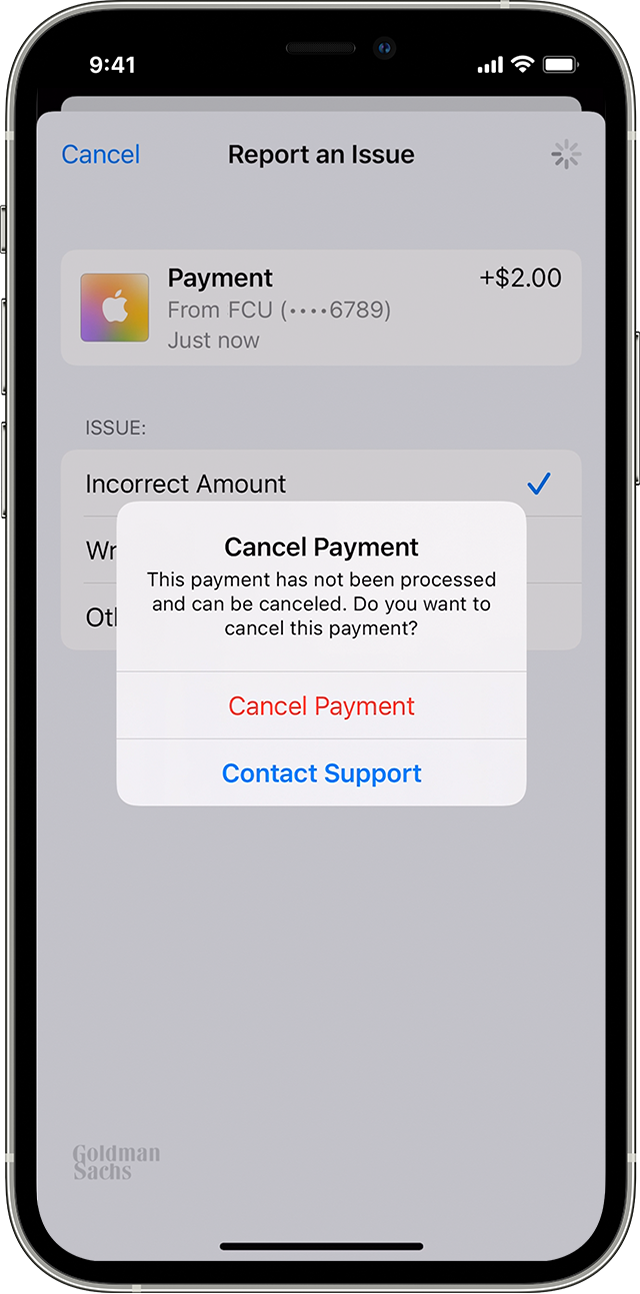

Cancel a payment

On iOS 14 or later, yous might be able to cancel a one-fourth dimension payment that hasn't been processed yet:

- On your iPhone, open up the Wallet app and tap Apple Card.

- Under Latest Transactions, tap the payment that you want to cancel.

- Tap the payment over again, then tap Report an Issue.

- Choose an issue, then tap Abolish Payment.

If you don't see Cancel Payment, tap Contact Support to chat with an Apple Carte specialist.

Choose or change a payment source

Add a bank account that y'all can utilise to make payments, or utilize Apple tree Greenbacks to help pay off your Apple Card balance. The first time y'all cull to add a banking company account, you're asked if you want to add the same bank business relationship that you use with Apple Cash. If y'all select Aye, the depository financial institution business relationship is automatically added.

Add together a banking company account

- Get your banking company business relationship number and bank routing number.

- Open the Wallet app on your iPhone and tap Apple tree Carte.

- Tap the more button

.

. - Scroll down and tap Bank Accounts.

- Tap Add a Bank Account, then follow the instructions on your screen.

You can add together multiple bank accounts to make payments. The starting time bank account you add together will be your default bank business relationship.

Delete a bank business relationship

Before you delete a depository financial institution account, y'all must delete any payments that yous set up using that banking concern account.

Then, open up the Wallet app on your iPhone and follow these steps:

- Tap Apple Card.

- Tap the more push button

.

. - Scroll downwards and tap Bank Accounts.

- Tap Edit.

- Tap the delete push

.

.

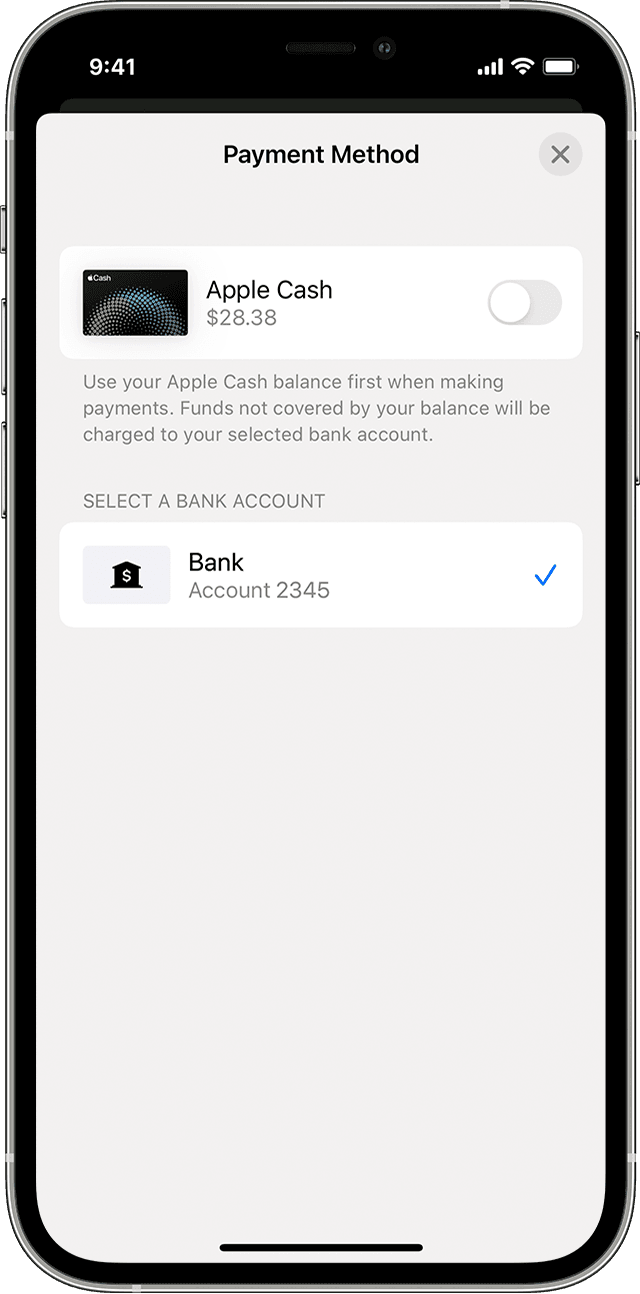

Pay with Apple Cash or a different banking concern account

If you choose Pay Now, you can utilise your Apple Greenbacks residue to brand an firsthand one-time payment. If the balance of your Apple Cash account is less than the amount of your payment, the remaining balance is paid from your default bank account.

You can also choose a different bank account to pay your Apple Card balance:

- Open the Wallet app on your iPhone and tap Apple Card.

- Tap to pay.

- Choose a payment amount and tap the Pay At present button.

- Tap your depository financial institution account, then choose a different bank account.

- Tap the Back push and authenticate with Face ID, Bear on ID, or your passcode to make a payment.

Turn payments with Apple Greenbacks on or off

If you want to pay from only your bank business relationship without using your Apple Cash residual, follow these steps:

- Open the Wallet app on your iPhone and tap Apple Carte du jour.

- Tap to pay.

- Choose a payment corporeality and tap Pay At present.

- Tap your banking concern account, and then plow Apple Cash on or off.

- Tap the Back push, then cosign with Confront ID, Bear upon ID, or passcode to make a payment.

See your payment history

To view your payment history, follow these steps:

- Open the Wallet app on your iPhone and tap Apple Bill of fare.

- Tap Bill of fare Balance.

- Scroll downward and select the Statement you lot want to view.

Next to Payments and Credits yous come across the amount of Payments and Credits from the month yous selected. If you want to download a PDF of the argument, tap Download PDF Statement. Payments and Credits includes payments you might accept fabricated, refunds on purchases you returned, and credits yous might take received from a transaction dispute.

Y'all tin also view individual payments. Just open the Wallet app on your iPhone and tap Apple Card. And so scroll through Latest Transactions until you see a Payment transaction. To meet the payment details, tap the transaction, and so tap information technology again on the next screen.

- Apple Menu is issued by Goldman Sachs Bank United states of america, Table salt Lake City Co-operative.

- Variable APRs range from eleven.24% to 22.24% based on creditworthiness. Rates as of April ane, 2022.

- Each co-owner is jointly and individually responsible for all balances on the co-owned Apple Card including amounts due on the existing co-possessor's account before the accounts are merged. Each co-owner will exist reported to credit bureaus every bit an owner on the account. In improver, co-owners will have full visibility into all account activity and each co-owner is responsible for the other co-owner's instructions or requests. Credit reporting includes positive and negative payment history, credit utilization and additional information. Card usage and payment history may impact each co-owner's credit score differently because each individual'south credit history will include information that is unique to them. Addition of a new co-owner is subject to credit approval and general eligibility requirements. Larn more than virtually Apple Card eligibility requirements. Either co-possessor tin can shut the account at any time which may negatively impact your credit and you will still be responsible for paying all balances on the account. Learn more than nigh business relationship sharing options, including some of the risks and benefits.

- You can only use your bank account to schedule a former payment.

Information about products not manufactured by Apple, or independent websites not controlled or tested by Apple, is provided without recommendation or endorsement. Apple tree assumes no responsibility with regard to the choice, operation, or utilize of third-political party websites or products. Apple makes no representations regarding third-party website accurateness or reliability. Contact the vendor for boosted information.

Published Date:

Source: https://support.apple.com/en-us/HT209226

Posted by: proctorthicy1960.blogspot.com

0 Response to "How To Change The View On Bill Pay Bank Of America"

Post a Comment